Buying a home is stressful enough without extra surprises. Now imagine you’re only a few days away from closing, your lender is ready, and your moving truck is on standby. Suddenly, you hear that the sale can’t go through because you don’t have a FEMA Elevation Certificate. This single piece of paper can decide whether your deal moves forward or stalls—especially this week as the National Flood Insurance Program (NFIP) faces a possible lapse in funding.

Why Flood Insurance Is in the Spotlight Right Now

Congress is currently debating whether to extend the NFIP, the program that backs most flood insurance policies in the country. If lawmakers don’t act, the program could shut down—at least temporarily. That would mean no new flood insurance policies can be issued. And without insurance, closings on homes in flood zones can’t happen.

For buyers, this is a big deal. Parts of Monroe County, especially areas near the Genesee River, Irondequoit Creek, and the Lake Ontario shoreline, fall into FEMA’s Special Flood Hazard Areas. If you’re buying in these zones, lenders usually require flood insurance. And to issue that insurance, companies often ask for a FEMA Elevation Certificate.

What a FEMA Elevation Certificate Actually Is

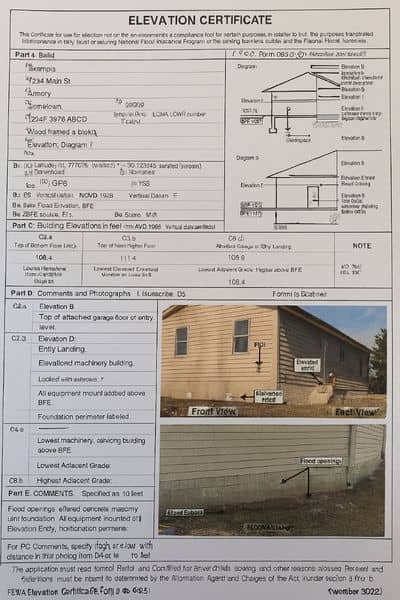

So what exactly is this document that holds so much power over your closing? A FEMA Elevation Certificate is an official form prepared by a licensed land surveyor. It measures the elevation of your home or building in relation to the area’s Base Flood Elevation (BFE).

In plain English: it tells the insurer how high your home sits compared to the level where floodwaters are expected during a major storm. That information determines if you need flood insurance, and if so, how much you’ll pay for it.

Without this certificate, insurers can’t give you an accurate quote. And without insurance, your lender won’t release funds. That’s why the FEMA Elevation Certificate is often the make-or-break factor for a closing in flood-prone areas.

How Closings Get Delayed Without It

Let’s look at a real scenario. Suppose you’re buying a house in Irondequoit near the creek. The property sits in a Zone AE flood area according to FEMA maps. Your lender says you need flood insurance. You call your agent, but they can’t finalize a policy without a FEMA Elevation Certificate.

Now you’re stuck waiting for a surveyor to come out, measure the property, and prepare the document. That process usually takes several days, sometimes a week. Meanwhile, your closing date is ticking closer. If the NFIP program pauses this week, even the insurance companies that do have your certificate might not be able to issue a policy until Congress acts. That means your entire deal could be delayed—or worse, canceled.

How to Know If You Need One

Not every property requires a FEMA Elevation Certificate. If you’re buying outside of FEMA’s mapped flood zones, you’re usually safe. But if the property touches a Zone A, AE, or VE on the FEMA Flood Insurance Rate Maps, you’ll likely need one.

The good news is that you can check this yourself before you even make an offer. Visit FEMA’s Map Service Center and plug in the property address. You can also look at Rochester’s National Flood Hazard Layer viewer for a local overlay. If the property lands inside a Special Flood Hazard Area, plan on ordering a certificate.

What’s Inside the Certificate

The FEMA Elevation Certificate isn’t just a sheet of numbers. It’s a detailed report that includes:

- The building’s lowest floor elevation

- The lowest adjacent grade around the property

- The Base Flood Elevation from FEMA’s maps

- A diagram that shows the building type

- Photos of the building’s openings and foundation

This data lets insurers calculate risk. Sometimes, the certificate even lowers premiums if it shows your house sits higher than FEMA’s mapped flood level.

Why Timing Matters This Week

Normally, ordering a FEMA Elevation Certificate is a routine step in the buying process. But timing is critical right now. With the NFIP on shaky ground, closings that depend on flood insurance could freeze if the program lapses.

That’s why buyers in flood zones can’t afford to wait. If your lender or insurance agent even hints that you’ll need a certificate, order it immediately. A licensed land surveyor can usually complete it in three to five business days, but rush orders are often possible if your closing is around the corner.

Tips for Buyers and Sellers

If you’re a buyer, ask your real estate agent upfront if the property is in a flood zone. Don’t assume the seller has a recent certificate. Even if they do, lenders and insurers may require an updated one, especially if the original is more than ten years old or if FEMA has revised the maps.

If you’re a seller, having a current FEMA Elevation Certificate ready can make your property more attractive. It removes uncertainty for buyers and speeds up the underwriting process. Think of it as part of your due diligence before putting the home on the market.

The Local Picture in Rochester

Rochester isn’t New Orleans or Miami, but flood risk is very real here. Lake Ontario flooding in recent years has caused property damage, and creeks like Irondequoit and Allen’s Creek overflow during heavy rains. That makes flood insurance, and by extension FEMA Elevation Certificates, an important part of the local real estate landscape.

Final Thoughts

The headline about Congress possibly letting the NFIP lapse may sound like distant Washington politics. But for families trying to buy or sell a home this week, it’s personal. A missing FEMA Elevation Certificate could mean your closing stalls or your dream home slips away.

The takeaway is simple: if your property is in or near a mapped flood zone, don’t wait until the last minute. Check the maps, talk to your lender, and order a certificate from a licensed land surveyor early in the process.

Because when deadlines collide with red tape, the smallest missing document can become the biggest deal-breaker.